Some of the most contentious modern blockchain debates revolve around “how to scale,” or how to accommodate more transaction volume while remaining secure and decentralized. Many believe that the best mechanisms to scale are by creating better, more efficient blockchains — known as Layer 1s — while others believe that building off-chain options — known as Layer 2s — that settle to existing blockchains is the path forward.

What is a layer 1 blockchain?

What is the difference between a Layer 1 and a Layer 2? Simply, a Layer 1 is what we traditionally think of as a “blockchain” — a network of computers that come to consensus on some form of information in a decentralized and trustless manner. Some examples of Layer 1s are Bitcoin, Ethereum, and Quai Network. All of these platforms have a native token (BTC, ETH, and QUAI respectively) that can be transferred between users. Layer 1s are traditionally public and permissionless, meaning that any computer can enter and exit the network as a node or miner at will.

But what happens when there’s more transaction volume than the Layer 1 can handle? Traditional Layer 1s like Bitcoin and Ethereum have strict upper limits on how many transactions-per-second can be processed. When demand exceeds these limits, bidding wars begin to get transactions included on the blockchain, leading to the high transaction fees we all know and hate.

What is a layer 2 blockchain?

The primary path forward for traditional Layer 1s is to scale through Layer 2s, or off-chain channels. These work by creating a separate, often privately maintained ledger where each transaction is not executed on the Layer 1. These Layer 2s, or side-channels, can process massive amounts of transaction volume, because they do not experience the same block space limitations as the Layer 1.

In the context of Layer 1s and Layer 2s, Layer 1s are often referred to as the “settlement layer,” where transactions that occur on the Layer 2 are eventually “settled,” or confirmed by the Layer 1.

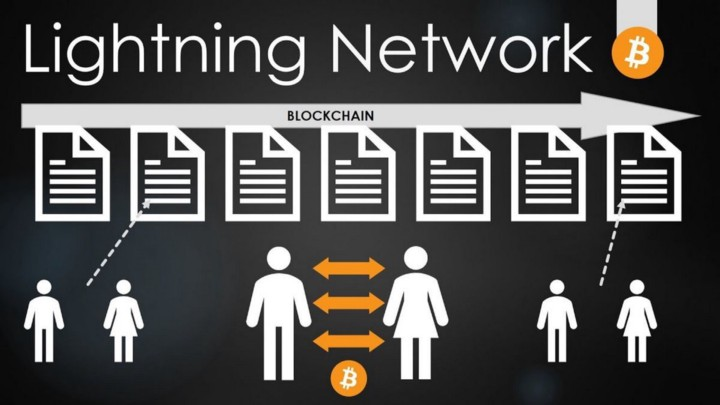

In the case of Bitcoin, scalability is occurring on the Lightning Network — a Layer 2 solution where users deposit funds into a two-party Bitcoin multisig wallet, where funds can only be transferred if both users agree on the transaction. Both parties have the option to unilaterally exit the agreement at any point, meaning that funds in the Lightning Network can always be redeemed for on-chain Bitcoin.

The most common example used to analogize the Lightning Network is a bar tab — two individuals enter a trusted agreement, where not every transaction is immediately “settled.” These tabs can enable potentially unlimited peer-to-peer transactions to occur, with settlement only having to occur at the end of each tab.

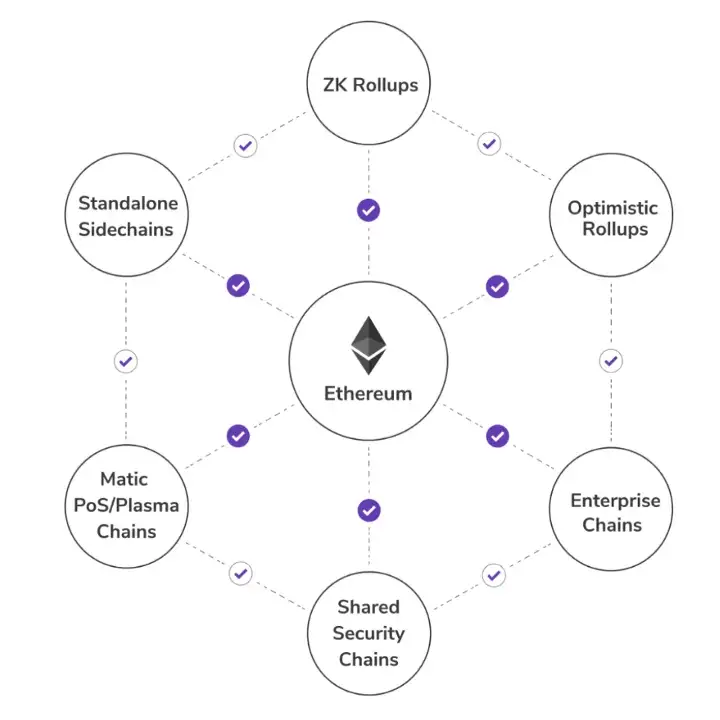

For Ethereum, the future of scalability is also in the form of Layer 2s, although much less uniform. There are a variety of technologies being used to create off-chain solutions for Ethereum, including Optimistic Rollups, ZK Rollups, Validium, and Plasma. There are more than 15 Ethereum Layer 2s with more than $1 million TVL, demonstrating extreme diversity in the Layer 2 ecosystem.

While this diverse ecosystem has led to impressive technological advancements, the sheer number of legitimate Layer 2s brings its own problems — the more users are split into non-interoperable Layer 2 solutions, the less effective Layer 2s as a whole are at minimizing on-chain activity. Without a universal or native solution, Ethereum Layer 2s have to compete for adoption against each other, creating a convoluted and inefficient environment where users have to either choose a Layer 2 ecosystem to silo themselves into, or remain on-chain with high fees.

While Layer 2s are widely accepted as the optimal scalability solution by traditional Layer 1s like Bitcoin and Ethereum, a new generation of Layer 1s, such as Quai Network, attempt to accommodate more transaction volume within the Layer 1 itself instead of resorting to off-chain solutions.

Better alternatives: What is Quai Network?

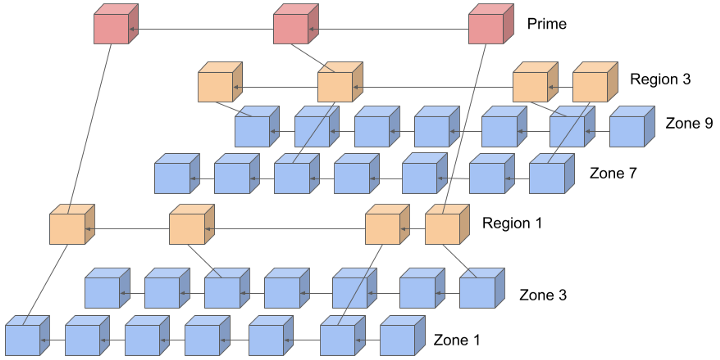

Quai Network essentially integrates Layer 2 solutions natively into the Layer 1, where users never have to compromise security or interoperability for low-cost transactions. Quai Network achieves this through a combination of merged mining and sharding, allowing miners to secure multiple chains with the hashpower they produce.

Quai Network exists in a hierarchical structure, beginning with the single Prime Chain, mined by all Quai Network miners. The Prime Chain is sharded into three Region Chains, which are each sharded into three Zone Chains. Each of these chains produce blocks asynchronously, with security ensured throughout the hierarchy by coincident blocks.

With a 13-chain EVM-compatable modular network, Quai Network natively supports cross-chain transactions between all chains. This allows users to spend and receive funds from any chain, with any state change eventually being confirmed by the Prime Chain, which is the chain secured by 100% of network hashpower.

Through this novel combination of sharding and merged mining, Quai Network achieves a user-friendly, low-fee, and high-speed blockchain network that remains extremely decentralized and secure.

Quai Network is approaching its third Testnet, the Iron Age Testnet, with a variety of bounties for both miners and developers. With 12 million Quai tokens up for grabs, the Iron Age Testnet will be a prime opportunity to explore the network and its capabilities while earning Mainnet Quai tokens.

Join us to build a better blockchain.

Quai Network is an open-source Proof-of-Entropy-Minima blockchain network utilizing the capabilities of merged mining to increase throughput and security. Users of Quai Network will enjoy fast transaction times without compromising decentralization and security. Miners will have competitive mining opportunities across the many blockchains within the network.

Capable of thousands of transactions per second, the Quai Network is a new solution to scalability that is soon to be ready for mainnet release.

Terms & Conditions / Disclaimer

The entirety of the Quai Genesis grants program, including the content of this article, is subject to the Terms and Conditions outlined here.

Opinions, ideas, and statements shared in this update are delivered with numerous assumptions, risks, and uncertainties which are subject to change over time. There are multiple risk factors, including those related to blockchain, cryptographic systems, and technologies generally, as well Quai’s business, operations and results of operations, that could cause actual results or developments anticipated not to be realized or, even if substantially realized, to fail to achieve any or all of the benefits that could be expected therefrom. We reserve the right to unilaterally, completely, or partially change plans, expectations, and intentions stated herein at any time and for any reason, in our sole and absolute discretion, and we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise. ACCORDINGLY, WE RECOMMEND THAT YOU DO NOT RELY ON, AND DO NOT MAKE ANY FINANCIAL DECISION OR INVESTMENT BASED ON, THE STATEMENTS CONTAINED IN THIS UPDATE OR ANY OF OUR UPDATES/ARTICLES — INCLUDING BUT NOT LIMITED TO ANY SELLING OR TRADING OF QUAI TOKENS, ETHER, OR ANY OTHER CRYPTOGRAPHIC OR BLOCKCHAIN TOKEN, OR THE SECURITIES OF ANY COMPANY.

The views, opinions, and statements made in this update are those of an individual author and not those of any institution, University, or legal entity operating within the jurisdiction of The United States or beyond. There is no association between these views, opinions, and statements and any for-profit or non-profit entity, particularly with Universities, Foundations, and other Agencies located within the United States. Any perception of such an association is purely accidental, and will be rectified immediately if brought to our attention by the reader.