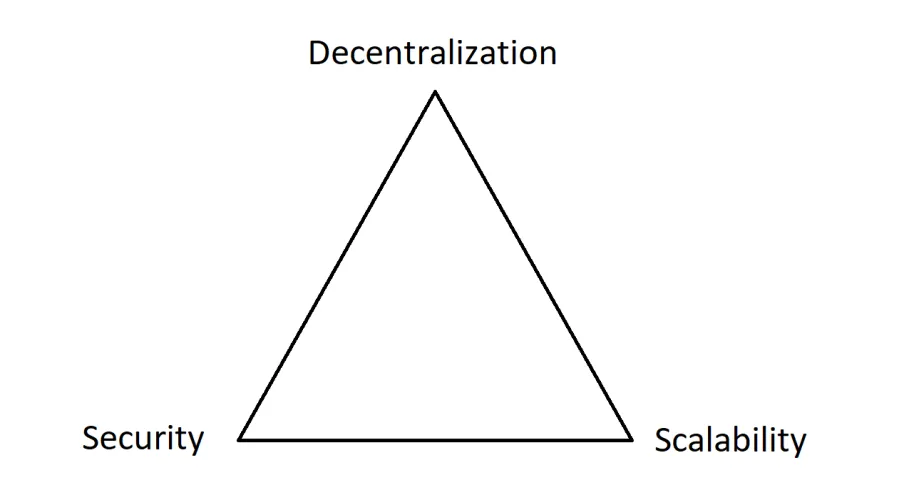

The scalability trilemma is a widely circulated theory describing the relationships between decentralization, security, and scalability in a decentralized system. With the continued rise in demand for decentralization, the question of whether or not the blockchain trilemma can be solved demands an answer.

What is the blockchain trilemma problem?

First introduced by Ethereum’s Vitalik Buterin, the “blockchain trilemma” or “scalability trilemma” theorizes on the limitations of blockchain technology. The scalability trilemma is loosely based on Eric Brewer’s CAP theorem, which focuses on the limitations of traditional databases. The CAP theorem is a well-defined concept in computer science examining the relationships between consistency, data availability, and partition tolerance in a database.

The blockchain/scalability trilemma argues that similar to the CAP theorem, there are three core traits of blockchains that exist in a zero sum game. These three traits are identified as decentralization, security, and scalability. According to the trilemma, most efforts to enhance one of these three traits will inevitably result in a tradeoff against the other traits.

The scalability trilemma can be useful when taking a broad perspective of blockchains, as existing platforms can be plotted in the trilemma. Bitcoin, for example, has demonstrated its powerful decentralization and security, but remains unscalable. Protocols like Solana, in contrast, have demonstrated strong scalability with a sacrifice to decentralization and security.

What tradeoffs do cryptocurrencies have to weigh?

The blockchain space has transformed rapidly from a small group of cypherpunks to a multi-billion dollar industry, bringing a multitude of new perspectives on the technology in its wake. While decentralization and censorship resistance were the main focus of the early cypherpunks, new priorities have emerged from users and protocols that emphasize scalability over all else.

With blockchain technology gaining popularity around the globe and governments beginning to express regulatory interest, protocols that compromise decentralization and security for scale may seem temporarily appealing, but fail to achieve the goals of censorship resistance and trustlessness that cryptocurrencies initially set out to address.

For individuals looking to prioritize decentralization, an immediate reaction from the scalability trilemma may be that any project achieving greater scale than Ethereum is inherently sacrificing decentralization or security. However, while the aggregate relationship between decentralization, security, and scalability can be loosely plotted with the scalability trilemma, the direct relationships between the properties are not as linear as displayed. Bitcoin, for example, if plotted at the midpoint between security and decentralization, has no way to directly move along the axis of security and decentralization as the two traits are so closely interlinked.

Even though these direct relationships are not linear, the concept of the trilemma as a whole does have value: most simple proposals to scale, such as increasing block size/reducing block time result in increased state size and latency requirements, impacting decentralization.

In addition, Vitalik has identified technologies — most notably, sharding — that can allow a blockchain to scale outside of the limitations of the blockchain trilemma.

The raging debates between Proof-of-Work and Proof-of-Stake have their place in the trilemma conversation as well — while the method of sybil resistance used does not impact a blockchain’s scalability, it can have major implications for its threshold of censorship resistance and security.

At a broad scale, cryptocurrencies must weigh their priority on decentralization and censorship resistance at inception. Projects without a focus on decentralization may have their place in the industry, but for blockchains truly looking to change the world in a revolutionary way, decentralization is essential. A focus on decentralization is a significant commitment for a project to make, however, as enhanced decentralization tends to impact scalability as demonstrated by the trilemma.

Have any cryptocurrencies solved the trilemma?

While the scalability trilemma has been widely circulated, Quai Network is a pre-Mainnet network of blockchains that acts outside of the traditional trilemma, offering the only decentralized solution that can scale to global demand. Quai Network utilizes a novel combination of sharding (noted by Vitalik to act outside of the trilemma) and merged mining (noted by Satoshi to not impact the security of the parent chain) to achieve scale while retaining decentralization and security.

Vitalik identifies multi-chain ecosystems as sacrificing security, as a malicious entity would only need to retain control of one “subchain,” often secured by less than the security of the entire network, to conduct a successful attack. This is true for multi-chain networks not taking advantage of merged mining. In Quai Network, retaining control of one “subchain” would require 51% of the entire network’s hashpower, leading to no reduction in security in Quai’s multi-chain ecosystem when compared to a monolithic system.

In Quai Network, each miner secures three blockchains simultaneously with their hashpower, resulting in more ecologically-friendly and lower-cost transactions. All Quai chains share the security of the entire network with overlapping sets of miners interweaving Quai’s merged mined chains together.

Quai utilizes a unique combination of sharding and merged mining to create a single braided chain. Through the use of this sharded & merge mined multi-chain structure, Quai Network solves the blockchain trilemma. With the ability to offer low-cost transactions at scale in a highly secure and decentralized environment, Quai is the only protocol primed to break the blockchain trilemma and enable a new era of decentralized commerce.

Conclusion

The scalability trilemma can be a useful way of quickly measuring where projects make tradeoffs, but technologies like sharding and merged mining can also allow projects like Quai to exist outside of the trilemma’s limitations. With projects like Quai reimagining the capabilities of blockchains, the perspective presented by the trilemma may not remain accurate much longer.

The ideas of sharding and merged mining predate the scalability trilemma by many years, but have yet to be cohesively implemented in a single project. By bringing the immense potential of these two technologies together, Quai Network is the first and only decentralized blockchain to break the scalability trilemma.

Join us to build a better blockchain.

Quai Network is an open-source Proof-of-Entropy-Minima blockchain network utilizing the capabilities of merged mining to increase throughput and security. Users of Quai Network will enjoy fast transaction times without compromising decentralization and security. Miners will have competitive mining opportunities across the many blockchains within the network.

Capable of thousands of transactions per second, the Quai Network is a new solution to scalability that is soon to be ready for mainnet release.

Terms & Conditions / Disclaimer

The entirety of the Quai Genesis grants program, including the content of this article, is subject to the Terms and Conditions outlined here.

Opinions, ideas, and statements shared in this update are delivered with numerous assumptions, risks, and uncertainties which are subject to change over time. There are multiple risk factors, including those related to blockchain, cryptographic systems, and technologies generally, as well Quai’s business, operations and results of operations, that could cause actual results or developments anticipated not to be realized or, even if substantially realized, to fail to achieve any or all of the benefits that could be expected therefrom. We reserve the right to unilaterally, completely, or partially change plans, expectations, and intentions stated herein at any time and for any reason, in our sole and absolute discretion, and we undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise. ACCORDINGLY, WE RECOMMEND THAT YOU DO NOT RELY ON, AND DO NOT MAKE ANY FINANCIAL DECISION OR INVESTMENT BASED ON, THE STATEMENTS CONTAINED IN THIS UPDATE OR ANY OF OUR UPDATES/ARTICLES — INCLUDING BUT NOT LIMITED TO ANY SELLING OR TRADING OF QUAI TOKENS, ETHER, OR ANY OTHER CRYPTOGRAPHIC OR BLOCKCHAIN TOKEN, OR THE SECURITIES OF ANY COMPANY.

The views, opinions, and statements made in this update are those of an individual author and not those of any institution, University, or legal entity operating within the jurisdiction of The United States or beyond. There is no association between these views, opinions, and statements and any for-profit or non-profit entity, particularly with Universities, Foundations, and other Agencies located within the United States. Any perception of such an association is purely accidental, and will be rectified immediately if brought to our attention by the reader.