TL;DR

- QI is a “decentralized energy dollar” backed by energy

- Quai Network introduces a dual token model (QUAI and QI) with different emission functions to balance miner incentives and network needs.

- Quai Network introduces an unprecedented hierarchical blockchain structure with inherited blockchain security:

- Prime chains (highest security)

- Region chains (medium security)

- Zone chains (optimized for transactions, inheriting security from higher chains)

- Quai’s dynamic sharding enables superior scalability:

- Add or remove chains based on network demand

- Maintain low transaction costs and high throughput

how quai presents a global solution for money

For over a decade, a global movement has emerged to escape the traditional fiat monetary system. This shift is propelled by factors such as rising inflation, expensive and slow international transfers, local currency illiquidity, and geopolitical instability. While crypto assets like Bitcoin and stablecoins have been proposed as alternatives, they come with their own set of limitations.

These existing solutions, though innovative, fall short of addressing all the challenges they aim to solve. Bitcoin’s decentralized and secure network is hampered by high volatility and scaling issues, limiting its practicality for everyday transactions. Stablecoins, while offering cheaper global transfers and stability, still rely on centralized authorities similar to the very fiat currencies they seek to replace. This leaves a gap in the market for a new solution.

Enter Quai Network, the only scalable and programmable Proof-of-Work blockchain with the first decentralized energy dollar. Which is charting a new course for the future of global finance, aiming to combine the best features of existing solutions while addressing their shortcomings. This article explores three key dimensions of Quai Network that position it as a compelling option for global money:

- QI: Quai’s blockchain-native medium of exchange

- Enhanced security through a hierarchical blockchain structure

- Superior scalability via dynamic sharding

QI

The QI token serves as the Quai Network’s medium of exchange, a foundational part of Quai’s goal of facilitating global value transfer and settlement.

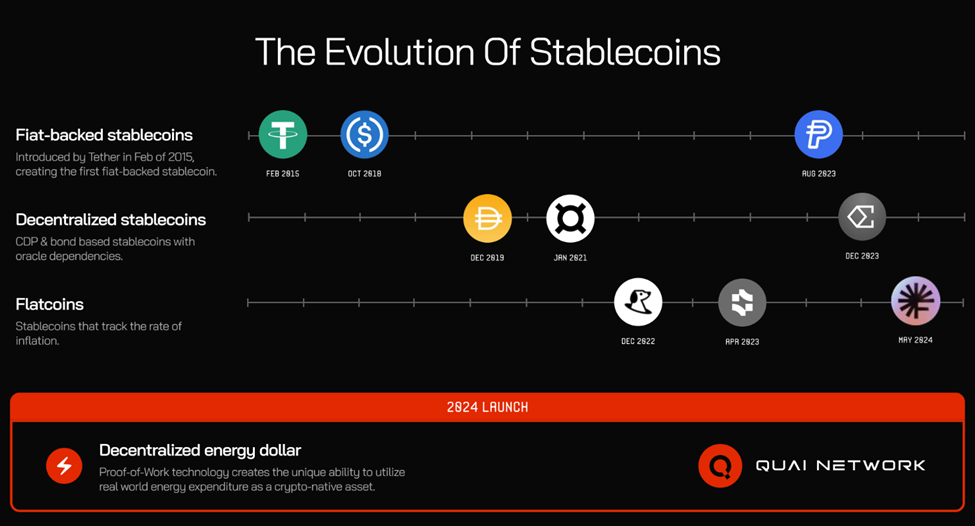

QI is a stablecoin-alternative that has vastly different characteristics than its predecessors. Almost all stablecoins in the current market fall into one of the following categories:

- Fiat-backed stablecoins

- Decentralized stablecoins (backed by multiple assets)

- Flatcoins (track the rate of inflation)

QI falls into a completely new category: a “decentralized energy dollar.”

QI is designed to reflect the best features of BTC and stablecoins, both of which have already shown they have demand and utilization on a global scale. Specifically, three core elements make QI stand out:

- Backed by tangible and measurable value: Instead of being backed by government debt, QI is backed by energy

- QI’s emission rate fluctuates with the network’s hashrate, and its price reflects the input cost of energy associated with the hashrate-based emissions.

- Decentralized: Paid to anyone mining the Quai network who elects to receive QI

- With Quai’s low barrier to entry for miners, QI will potentially be emitted to a wide range of participants, creating a naturally decentralized supply.

- Scalable: Emissions are based on network activity

- More network activity results in more QI emissions, making QI inherently built to meet increasing liquidity needs on its network

Proof-of-Work (PoW) is fundamental to enabling an asset like QI, as it serves as a real-time oracle for energy demand based on the network’s hashrate. In this system, fluctuations in energy demand are directly reflected in the cost of mining on the Quai network. As energy demand rises, there is a proportional increase in QI emissions. This dynamic relationship ensures that QI rewards scale in tandem with the network’s energy consumption, creating a self-adjusting economic model. The result is a system where the magnitude of QI rewards is intrinsically linked to the overall demand for energy within the network, providing a unique and responsive approach to the token emission.

Next, we’ll take a look at QI’s role alongside the QUAI token in the network’s dual token model.

Reward Functions: Logarithmic vs. Linear

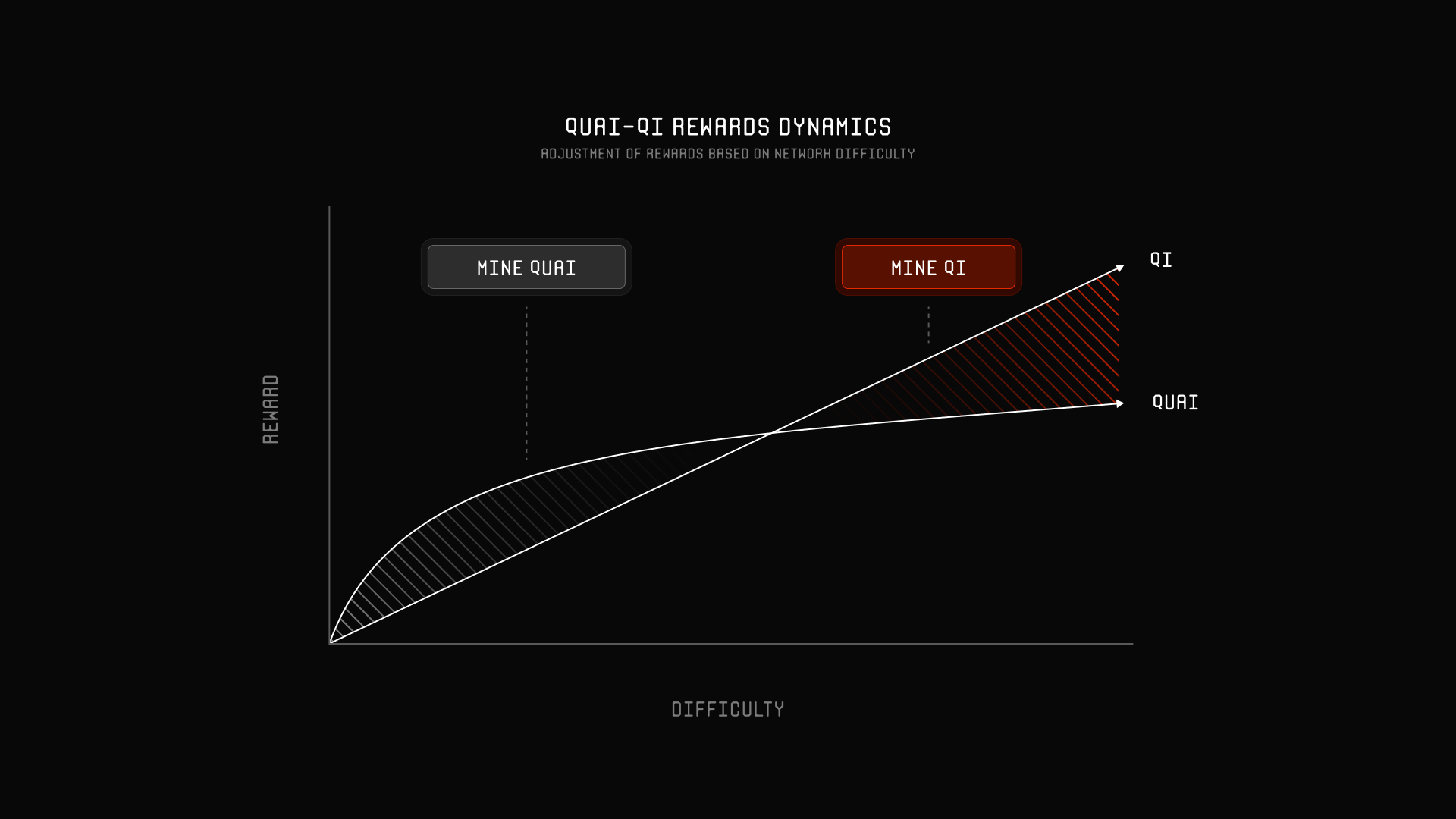

QUAI and QI employ distinct emission functions to ensure balanced miner incentives.

QUAI rewards follow a logarithmic function, increasing with difficulty but at a decreasing rate. This model creates a more stable and predictable supply over time.

QI rewards use a linear function, directly proportional to the hashrate required to mine a block. This allows QI emissions to dynamically respond to network activity and energy demand.

The difference in each token’s emissions creates a unique impact on miner decisions. At any given time, miners may prefer to mine one token over the other based on its cost to mine, its difficulty, or its market price.

Additionally, miners may favor one token in particular due to its emission schedule. While QUAI’s logarithmic emission schedule favors long-term stability and scarcity, QI’s linear emission schedule may offer more favorable immediate returns, particularly if network activity is high. Ultimately, this dual token model effectively balances short-term incentives with long-term value creation, promoting the fulfillment of immediate and future needs alike.

Continuous Adjustment Mechanism

Rewards are constantly adjusted for QUAI and QI with every new block. This rolling adjustment process ensures that the emission rates remain responsive to real-time changes in mining difficulty and network activity. For Quai, the adjustment is logarithmic, creating a gradual change in rewards. For QI, the adjustment is linear, making it highly responsive to fluctuations in hashrate.

This dynamic adjustment mechanism helps stabilize the token supply and maintains a balanced incentive structure for miners. As network demand increases, QI emissions can quickly scale up to meet liquidity needs, while Quai emissions adjust more conservatively, preserving long-term value.

One-Way Conversion Function

Quai’s unique one-way conversion function allows users to burn QI and mint QUAI at the current reward ratio. This mechanism provides a flexible way to manage token supply and demand within the network. When QI is burned to mint QUAI, it potentially increases the value of QI by reducing its total supply, while also increasing liquidity for QUAI.

This function serves as a tool for users to balance their holdings based on market conditions and mining incentives. It also adds a layer of economic flexibility, allowing the network to self-regulate and respond to changes in energy demand and token usage.

Quai’s Hierarchical Infrastructure

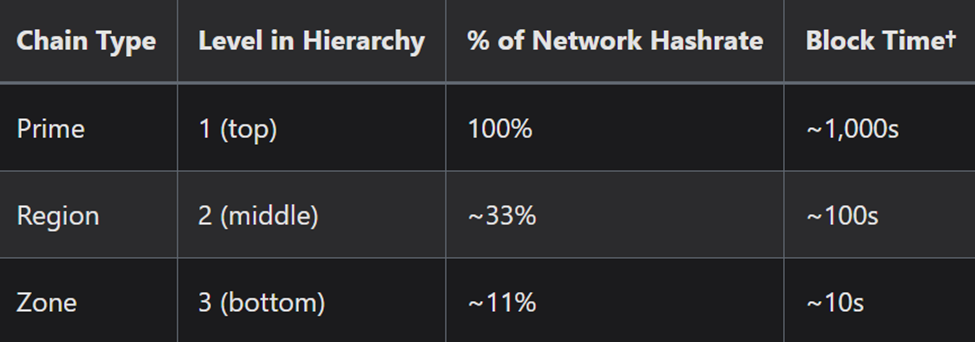

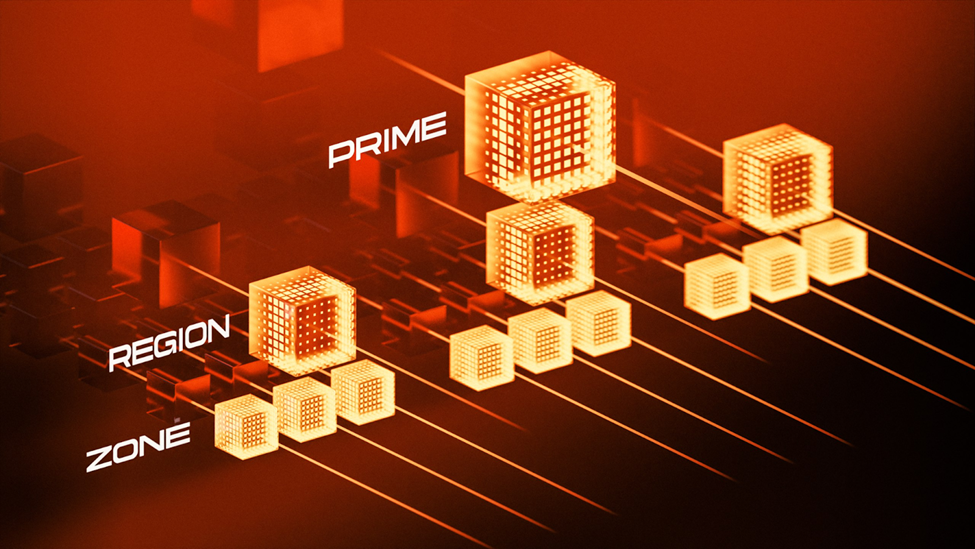

Blockchain networks in today’s world opt for high scalability at the cost of security, or sacrifice scalability to bolster their security. Quai, on the other hand, achieves infinite scalability alongside robust security. This is made possible via Quai’s unique approach to blockchain architecture, which splits the network up into three different types of blockchains: Prime, Region, and Zone chains.

This hierarchical infrastructure essentially allows the network to prioritize security on some chains and scalability on others, while the network as a whole retains the security of the most robust chain.

Prime Chains

At launch, there will be a single prime chain, which can be thought of as the fortress of the Quai network. The prime chain is the only chain that all miners mine by default. So, it will have the highest hashrate, which increases difficulty. A high difficulty level requires more energy to mine, which means the prime chain will naturally have the highest security.

Region Chains

Region chains represent the second tier of Quai’s infrastructure. While there is no technical limit to the number of operational region chains on Quai, there will be 1 region chain when the network launches. Each miner can only mine one region chain in addition to the prime chain, which means that when the network expands and a second region chain is deployed, each one will each be secured with approximately 50% of the prime chain’s total hashrate.

Zone Chains

Zone chains are at the bottom of the Quai network hierarchy, and are also the only chains within the network that maintain state and process transactions. At launch, there will be one zone chain, and similar to region chains, miners can only mine one zone chain at a time. So, when there are 3 region chains and 3 zone chains (9 zone chains total), each zone chain will be secured with roughly 11.1% of the total network hashrate. With a block time of just 10 seconds, zone chains are also the fastest part of the Quai network, but they still inherit the robust security of the Prime chain.

Further benefits of Quai’s hierarchical infrastructure will be explored in a later post, but the key takeaway from a security standpoint is that all chains inherit the security of the prime chain. That means zone chains, which are built for high-throughput applications, don’t acquire their scalability at the cost of security. Rather, Quai enables them to have both at the same time.

Security Inheritance

Quai’s hierarchical infrastructure allows for differentiated security levels across the network. Since the prime chain is mined by all participants, it has the highest difficulty and therefore energy requirements. Therefore, the prime chain serves as the most secure layer in the network. However, its security is inherited by region and zone chains via their connections to the prime chain.

Through security inheritance, zone chains can be optimized for high-throughput applications while still benefiting from the robust security of the prime chain. Therefore, the Quai network’s hierarchical design ensures that all transactions within the network are protected by the same high level of security, regardless of the specific chain they occur on.

Dynamic Sharding

While Proof-of-Work blockchains can be strong in terms of security, they notoriously lack scalability, which is a huge limitation for Bitcoin. However, to service a global community, a network must be able to scale efficiently.

Quai addresses this need by using a process called sharding. In simple terms, sharding aims to break up parts of a blockchain network to scale. Each shard processes its own transactions and/or hosts its own smart contracts, spreading the pressure across many different nodes. This ultimately keeps transaction costs low and throughput high across the network.

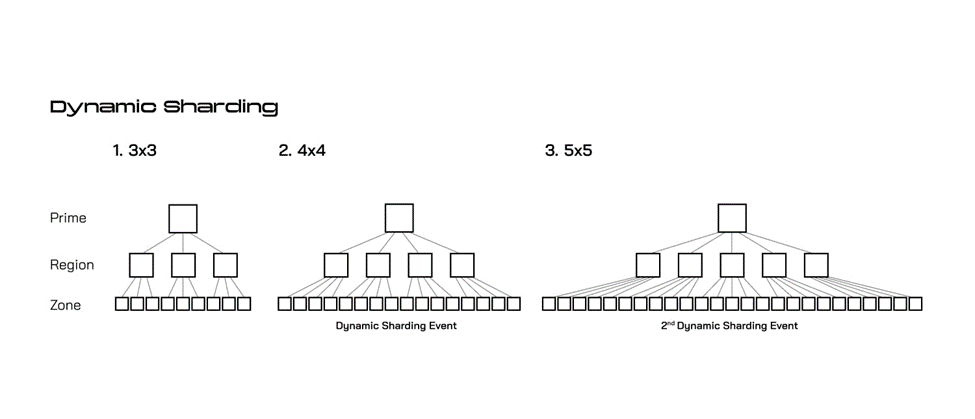

Quai leverages its custom-built chain hierarchy to make sharding efficient and dynamic. Specifically, the Quai network can create and remove Region and Zone chains depending on network demand, known as “Dynamic Sharding.”

When Quai launches, it will contain a 3×3 structure (3 Zone chains per Region chain, 3 Region Chains per Prime chain). However, if network activity spikes, the network will automatically grow to a 4×4 structure, which includes 4 Region chains and 16 Zone chains. More chains, or “shards,” will continue to be added or removed based on the rate of uncle blocks and the gas limit.

Conclusion

By using a blockchain-native medium of exchange and a unique infrastructure that efficiently distributes security without sacrificing scalability, Quai Network has the potential to improve upon all prior forms of blockchain-based payment systems. As we move towards main net launch this year, more insight will provide how Quai is furthering the future of money and dive deeper into its infrastructure. Stay tuned for more by following us on X and joining our community on Discord and Telegram!