TL;DR

- Stablecoins have become an important medium in the digital asset economy, providing global stability and access to on-chain US dollars.

- Popular stablecoins face challenges such as centralization risks, vulnerability to censorship, and high transaction fees during network congestion.

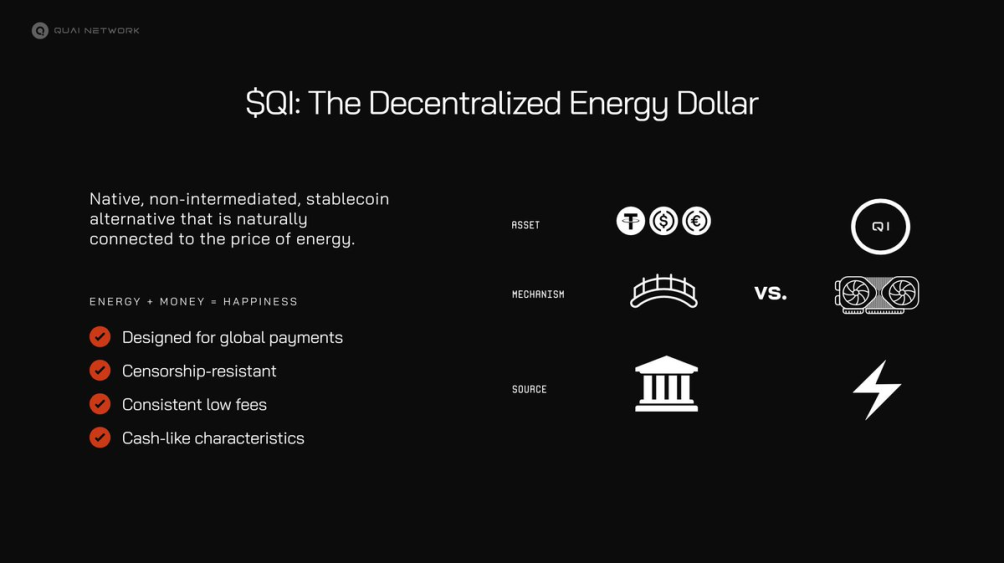

- QI, an energy-based Dollar, introduces a new type of stablecoin.

- Qi aims to address the limitations of current stablecoins by building Qi on a network run with POW that enables low transaction fees, is more decentralized, and has a stronger resistance to censorship.

Stablecoins have emerged as a tool to access fast, stable assets within the volatile digital asset-on-chain economy. Quai’s co-founder’s tweet thread delved into this phenomenon, highlighting the growing importance of these digital assets.

In the digital assets arena, Stablecoins have become essential as a means of exchange on-chain, offering stability and accessibility. Pegged to assets like the US dollar or gold, they provide a haven from price swings and enable on-chain participation without extreme volatility. With a combined market cap exceeding $160 billion, stablecoins continued to prove their utility in everyday transactions and complex financial services.

However, challenges persist, including centralization concerns, censorship vulnerability, and transaction fees. As we evaluate stablecoins’ impact and potential in democratizing access to stable digital currencies globally, new solutions like Quai’s QI token are emerging to address the remaining issues.

The Appeal of Stablecoins

One compelling aspect of stablecoins is their ability to provide near-instant global digital access to US dollars. For individuals in countries with unstable currencies or limited access to international banking, stablecoins can offer a lifeline to financial stability. This lifeline means they are a practical option for seamless cross-border transactions, facilitating remittances and international trade without the need for traditional banking intermediaries. Stability also proves massively useful for pricing goods and services, with reduced volatility risk.

The growing widespread adoption of stablecoins has significant implications for US Treasury demand, with stablecoin issuers collectively becoming major holders of US government debt. In the US, stablecoins also address many of the limitations of traditional payment apps like Venmo, PayPal, and CashApp.

While these platforms have revolutionized peer-to-peer payments, they often come with transfer limits, geographical restrictions, and processing delays. Stablecoins can offer near-instantaneous transfers without arbitrary limits.

Types of Stablecoins

- Energy-Based: QI

- Algorithmic: AMP, FRAX, ESD, MIM

- Yield Bearing: sDAI, USDe

- Centralized: USDC, Tether, Paypal USD

- Decentralized Stablecoins: (Backed by multiple assets), DAI

- Flatcoins: (Rate of inflation)

State of Stablecoins

The stablecoin market has experienced remarkable growth. It now boasts a total market capitalization of $160 billion, representing approximately 10% of the cryptocurrency market. This sector demonstrates significant liquidity, with weekly trading volumes surpassing $350 billion.

Leading stablecoins like Tether and USDC have expanded their presence across multiple blockchains, with Ethereum hosting $80 billion, Tron accommodating $60 billion, and Binance Smart Chain (BSC) holding $5 billion in stablecoin value.

Real-World Adoption of Stablecoins

So far, stablecoins have been among the most successful on-chain asset classes in finding product market fit. Popular use cases for stablecoins include:

- Consumer Payments

- Near instant settlement banks and financial institutions (Shift form T-1)

- On-chain payment for U.S. Treasuries, a multi-trillion-dollar asset class

- International Remittance

Opportunity in Developing Economies

Adoption is growing worldwide, particularly in developing regions like Latin America. Growth in these regions has intensified over increased economic instability. There are fears and examples of negative externalities of very high inflation or, in some cases, hyperinflation.

With this in mind, various use cases in developing economies with volatile monetary systems begin to emerge:

- Remittances

- International Trade

- Businesses for cross-border transactions

- Payments

In Argentina, for example, stablecoins account for roughly 80% of purchases. Figure 1 from a report by Chainalysis shows that stablecoins are a clear winner relative to other digital assets in Argentina, Brazil, Colombia, Mexico, and Venezuela.

Stablecoin Risks

Stablecoins have grown as a large means of exchange. However, many stablecoins suffer from similar risks that must be addressed.

The most popular stablecoins remain inextricably linked or connected to a form of centralized entity and fiat currencies. Many stablecoins are still beholden to traditional finance infrastructure, replicating the existing system but on a blockchain. This means stablecoins could be censored or even experience “de-pegging” events:

- Depegging risk—Failure of the underlying economic or algorithmic mechanisms through liquidity events, “bank run” scenarios, suboptimal reserves practices, and more present the risk of the stablecoin de-pegging from its target.

- Centralization risk—Centralized stablecoin issuers can freeze tokens at specific wallet addresses.

Examples of Risks

- 2023 SVB collapsed, and USDC depegged down to $0.88 due to $3.3B in Circle’s reserves being at risk.

- $2.51B of DAI collateral (~48%) is held/backed by Coinbase Custody, BlockTower, and USDC

- Chainlink is one of the largest dependencies for “decentralized” stablecoins

- Algorithmic stablecoins fail to maintain the sustaining pegs. E.g. ESD, Luna.

Recent innovations, such as inflation-tracking Flatcoins, aim to maintain consistent purchasing power compared to traditional fiat currencies. While Flatcoins address some issues of earlier stablecoins, they still rely on centralized oracles and lack protocol-native characteristics.

A significant challenge for stablecoins is their fee structure, particularly during periods of high network congestion. Transaction costs can become prohibitively expensive when on-chain activity surges, especially compared to traditional payment apps like PayPal, Venmo, and CashApp, which often offer free transfers.

To achieve global adoption and compete effectively with established payment solutions, stablecoins must reduce fees to near-zero levels. Given the current blockchain infrastructure and relatively limited user base, this remains a significant challenge.

Where does Quai fit in?

Quai Network’s presents a new approach to addressing the inherent challenges of traditional stablecoins. Quai’s stablecoin alternative, Qi, is a network-native stable token that derives its value from a crypto-native source: energy.

Deriving value from energy makes Qi unique because its value is intrinsically linked to the POW network’s energy usage. The dual-token model (QI and QUAI) makes this possible. Both have different roles, which aim to combat the challenges of over-reliance on centralization tied to “decentralized” stablecoins.

QI by Design

QI’s design supports efforts to make it a decentralized, scalable, and intrinsically backed stable means of exchange. As the native token of the UTXO shards within the Quai Network, QI leverages the unique properties of the UTXO ledger. This environment facilitates minimal programmability and enhanced transaction parallelization, improving latency and low transaction costs. These features make QI highly effective for use cases such as payments, transfers, and settlements.

QI Stability Mechanism

Key features such as the conversion feature and supply dynamics influence QI’s stability. These features position QI as a strong stablecoin alternative and medium of exchange, closely tied to energy costs. The interplay between these features allows for rapid supply adjustments in response to changes in demand, promoting stability to the QI token.

Conversion Feature

Any network participant can convert between QI and Quai at any time. The Quai Network allows conversion between existing QI and Quai tokens at the current block mining rewards ratio. For example, if the current Quai block reward is 1 and the current QI block reward is 2, any network participant would be able to burn QI tokens to mint new Quai tokens at a rate of 2:1.

This mechanism allows for greater responsiveness in the supply of QI, enabling all network participants, not just miners, to arbitrage between QI demand and QI supply, which can help stabilize token values in the future.

Supply Dynamic

Block rewards, difficulty adjustments, and miner choices influence the supply of QI.

QI block rewards are linearly proportional to mining difficulty, and miners in the Quai Network can choose to receive their rewards in either QI or Quai tokens. When choosing to mine QI ( inflationary token), the issuance is proportional to the “hashes” of difficulty or the expected number of hashes required to mine a block at the current difficulty level.

Hashrate, the computational power used for mining and processing transactions, plays a crucial role in Quai’s blockchain. When mining difficulty increases, QI rewards increase; if difficulty decreases, QI rewards decrease. This dynamic adjustment mechanism helps maintain the balance and stability of the QI token within the Quai Network.

QI as an Oracle

QI is built on innovation that utilizes a Proof-of-Work, to emit a currency in proportion to the network’s hashrate. Approaching the idea of stability through the lens of Proof-of-Work as an oracle allows the creation of something on-chain that isn’t pegged to an exact dollar value but rather a worldly good represented through energy expenditure.

This novel concept leverages Proof-of-Work to function as an oracle for real-world energy prices reflecting on-chain energy costs without direct exposure to energy industry operations.

By doing so, Quai aims to create a fully blockchain-based medium of exchange that maintains stability while remaining genuinely decentralized.

Quai’s network architecture mitigates censorship risks and other restrictions plaguing centralized stablecoins. This approach aligns more closely with the original vision of censorship-resistant and truly decentralized assets.

The Role of QI

QI is the new category for stablecoins: a “decentralized energy dollar”- a world first. Unlike traditional stablecoins, QI is not backed by any asset. Instead, it exclusively uses market incentives to consistently drive its price towards the cost of energy.

As the Quai Network’s medium of exchange, QI is fundamental to Quai’s goal of facilitating global value transfer and settlement. As a stablecoin alternative, QI possesses vastly different characteristics from its predecessors, setting it apart from almost all stablecoins currently in the market.

Key Features of QI

- Fixed denominations: Qi has fixed denominations and no scripting capabilities.

- Native token: Qi is the native token of the UTXO shards within the Quai Network.

- Supply dynamics: The Qi supply is determined by emissions (primarily through block rewards) and conversions between Qi and Quai tokens

- Miner choice: Miners can choose to receive block rewards in either Quai or Qi, affecting the actual supply emissions.

- Mining Reward: QI is earned by miners through block rewards.

> Miners can choose to earn either QUAI or QI.

> Supply starts at 0, ensuring true decentralization among miners.

> Mining is accessible, requiring only a decent GPU, further lowering entry barriers.

> Emissions rise and fall with the network’s hash rate. - Conversion feature: Anyone can convert between existing Qi and Quai at the current block mining rewards ratio.

> Potentially increases QI value by reducing supply

> Manages token supply and demand

> Increases QUAI liquidity

> Lets users adjust holdings based on market conditions

> Adds economic flexibility, enabling network self-regulation in response to energy demand and token usage changes - Stability mechanism: The supply dynamics and conversion features are designed to position Qi as a medium of exchange, with its value loosely tied to the cost of generating a hash (and thus the cost of energy)

- Responsive supply: The Qi supply is highly adaptive, with issuance and inflation rates directly proportional to demand.

- Gas Token: QI is a gas token for UTXO transactions within the Quai Network.

- Miner incentives: QI rewards are distributed using a linear function directly proportional to the hashrate required to mine a block. This allows QI emissions to respond dynamically to network activity and energy demand.

By combining these features, QI aims to offer a more decentralized, stable, and energy-efficient alternative to traditional stablecoins. Its unique approach to value derivation and distribution sets it apart in the evolving landscape of stablecoins.

Conclusion

Qi is addressing traditional stablecoins’ key risks and drawbacks. Despite their widespread adoption, there remains significant room for innovation, and QI serves as a viable bridge, offering an escape from volatile assets.

QI’s unique proposition lies in its native integration at the protocol level, independent from third-party oracles and external backing. Instead, it derives its intrinsic value from the energy powering the Proof-of-Work system. This approach enhances decentralization and provides a more robust and transparent mechanism for stability.

Unlike other stablecoins that rely on centralized elements, QI’s architecture reduces vulnerability to censorship, and the network’s design ensures low transaction fees for QI transfers.

Quai Networks’ novel technology and energy markets’ inherent properties, QI presents an alternative to stablecoins as they are today. As stablecoins evolve and gain adoption, innovations like QI pave the way for more resilient, decentralized, and energy-efficient financial instruments.